FPAC EXAM REVIEW COURSE INCLUDES

- Review of all FPAC topics and course material for exam 1 & 2.

- Practical experience using leading planning & analysis applications.

- Advanced financial modelling skills.

- Data visualization and presentation skills.

FPAC Exam Dates:

Feb/Mar 2022

Exam Registration:

Oct/Nov 2021

Instructor led course:

Oct 2021 to Jan 2022

The goal of the FP&A function is to improve business decisions by allocating capital to its best use. The FP&A professional is a financial expert, strategic and adept communicator, as well as a trusted advisor to the business. When you become certified in FP&A, you will prove that you have deep knowledge of the entire decision support process and are able to contribute to and be responsible for individual components of the process. You also will validate that you know how to perform these functions accurately and efficiently, and can identify, assess and adapt the processes to changes in the business environment.

Identify yourself as thebest candidate

As organisations around the globe continue to adjust to economic uncertainty and market unpredictability, there is a growing need for experienced FP&A professionals in the corporate environment.

Most firms are now recruiting the most qualified individuals to manage and analyse their organisation’s financial future. This unique professional designation will enable FP&A professionals to differentiate themselves within the financial profession and validate their understanding of modern FP&A processes, tools, and uniform standards.

FPAC Certification for FP&A Professionals

The FPAC is the only credential specific to FP&A and establishes the core competencies required for financial planning and analysis professional roles, addressing areas that are not necessarily covered by a traditional accounting degree/MBA.

Gain Accreditation in Areas Not Covered By A Traditional Degree with the FPAC Certification

– What you will learn –

Forecasting Techniques

- Advanced forecasting skills.

- Create accurate short and long-range plans and budgets.

- Demonstrate your passion for FP&A.

- Leading of FP&A teams and projects.

Financial Management

- Evaluate the business case for new markets and products.

- Gain deep understanding of financial statements, risk management concepts and business frameworks.

- Develop micro- and macro-economic concepts.

Data Visualization

- Heighten your ability to present and explain complex financial issues.

- Incorporate data visualisation techniques.

- Be a trusted business partner.

Capital Management

- Proactively manage investment processes.

- Create capital expenditure and investment analysis.

- Gain a working knowledge of working capital, finance options and financial decision types.

Financial Modeling

- Design and apply efficient financial analysis models.

- Develop confident assumptions.

- Draw accurate conclusions.

- Focus on future actions instead of past expenditure.

Data Management

- Manage data better.

- Work towards a networked and connected data system.

- Understand the ETL process for data warehousing, regulatory and security systems.

- Be a leader in data storage systems, information management, and data democratisation.

Standards of Ethical Conduct

- Maintain the highest standards of conduct.

- Demonstrate your obligation to your employers, co-workers, customers, shareholders, the profession, and yourself.

Demonstrate Your Passion for FP&A

- Earn and maintain FP&A certification.

- Confirm your commitment to your profession.

- Identify as someone ready to drive your organisation forward.

Build a Global Professional Network

- FPAC credential holders work in 65+ countries.

- Connect with peers via the virtual AFP Collaborate group.

- Attend the largest conference for treasury and finance professionals each year.

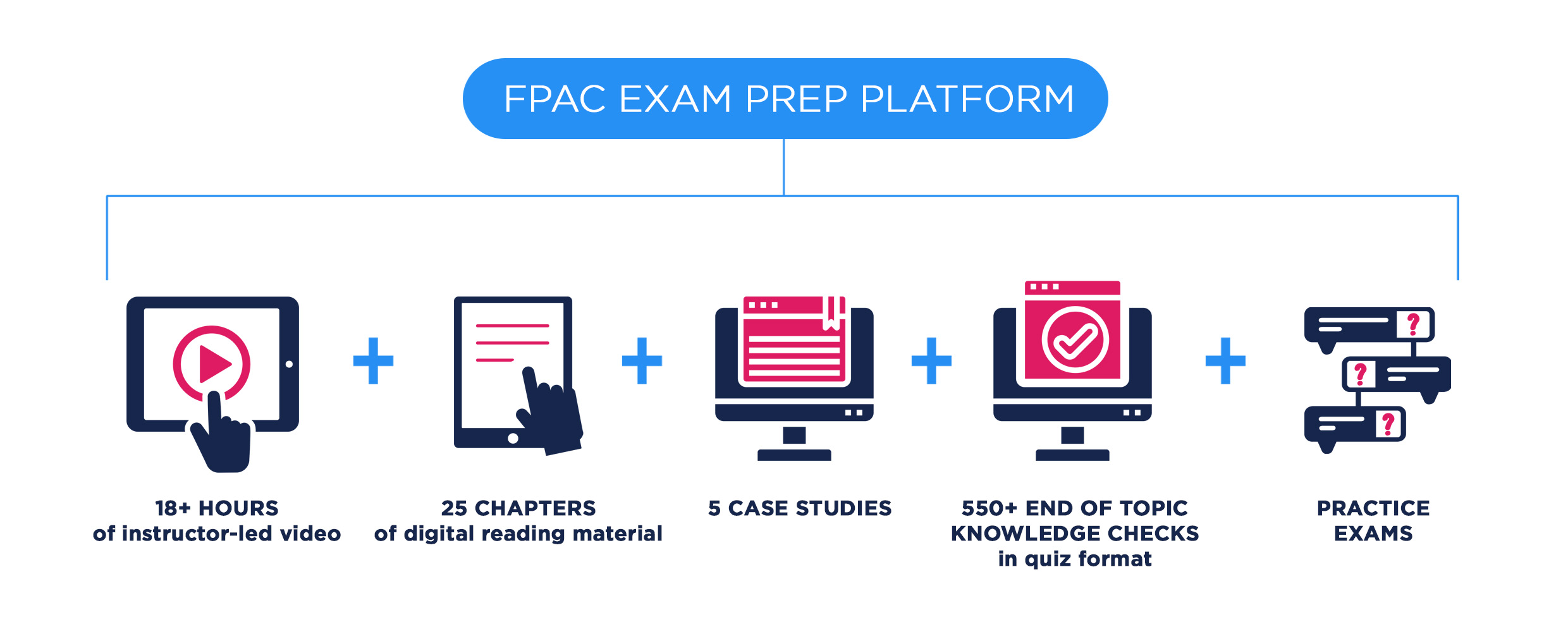

The FPAC Exam Prep Platform Contains:

The FP&A Exam Preparation Platform is a comprehensive study resource for the FPAC examinations.

- Fully Interactive, mobile friendly platform

- Customised progress tracking

- Built-in instructor-led instruction videos

- Step by Step study materials and evaluations

- Knowledge checks and sample exam questions

- Pre-tests, post-tests, case studies, and flashcards

- Progress reports

Kavee Wijayasekara ACMA, CGMA

Kavee Wijayasekara is a Director of PMsquare and has over 20 years of international experience developing FP&A platforms, managing FP&A functions and leading FP&A teams in some of the world’s most renowned companies. He also has many years of experience conducting training sessions on applications like IBM Planning Analytics, SPSS, as well as how to implement Fast Close, rolling forecasts, and predictive models.

12 Week FPAC Exam Review Course with Live Instructor (online)

October to January 2022

Weekend students:

Saturday 9:00 AM to 12:00 PM (3 days a month)

Weekday students:

Tuesday 6:00 PM to 8:00 PM (4 days a month)

Who is the AFP?

Headquartered outside Washington D.C. with a regional office in Singapore, the Association for Financial Professionals (AFP) is the recognised, global association for financial professionals. The AFP is a community of the best and brightest in Treasury and Finance, who are dedicated to helping FP&A professionals succeed by providing you with the right tools to STAND OUT and advance your career.

Who should earn the FPAC Certification?

Finance professionals who want to…

- Develop their FP&A team and skillset.

- Learn how to use digital tools to improve agility and processes.

- Access the latest data, trends, and insights in FP&A practices.

- Explore industry specific publications and data tools.

- Demonstrate the value of a new program to stakeholders.

- Connect with peers for real time feedback.

- Advance their career.